Requirements really should not be entered on the based on the credit estimate. To use so it equipment, enter in the necessary amount borrowed, the newest loan’s name, the interest rate, plus common fees regularity. The new calculator is actually designed to assume dominant and you can attention costs. Lenders essentially believe that their mastercard limitation are totally pulled, and takes on your pay off ~2-3% of your own restriction each month (although this can differ around the some other loan providers). Centered on these two items of suggestions, our very own calculator work it’s magic to choose simply how much household you are capable afford. As we firmly prompt one to provides a discussion that have a Financing Administrator to review your unique financial situation and requires, we hope that this tool will allow you to get started with the process.

- A big deposit will generally make the financial giving your to own a higher loan amount while they view you because the a low-exposure borrower.

- The property will act as shelter to your mortgage, meaning if you’re able to’t maintain repayments, the lending company you may repossess your residence.

- Very home loan calculators explore comparable formulas as to what lenders have fun with, so they really’lso are a powerful way to score an idea of just how one thing will be when you initially take out your loan.

Property Using Principles

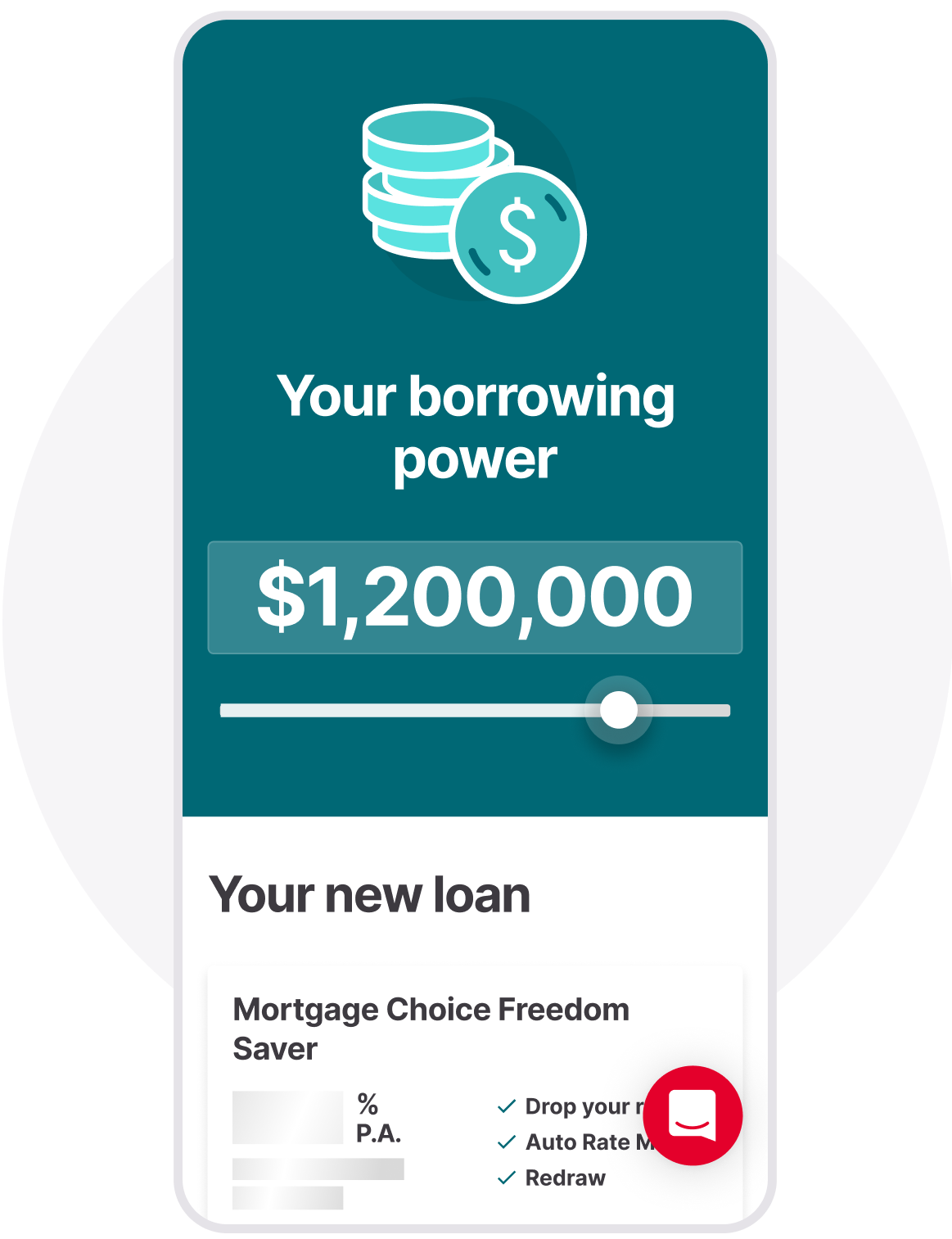

All of our credit calculator was designed to estimate just how much you can also have the ability to acquire based on your revenue, costs, and you may monetary obligations. It does not reason for the put because your put affects the full property price you can afford, rather than the matter you’re able to acquire from the lending company. The brand new data don’t take into account costs, fees or any other numbers which can be recharged on the loan (such month-to-month provider charges or stamp obligations). Lenders’ Mortgage Insurance coverage or a minimal Put Superior get affect your loan with regards to the sized your deposit; shelter, applicant and you will loan features. These a lot more number increase money beneath the mortgage.

The greater amount of credit power or capacity you have got, the better the loan number or borrowing limit you could discovered. Overall performance don’t depict sometimes rates otherwise pre-certification to the unit. You might imagine getting rid of her or him and you may reducing the newest restrict on the one notes you retain, as the loan providers often think any credit cards as keen on its full restrict. For example, for those who have two handmade cards, you to that have a $5,000 limitation and also the almost every other with $10,one hundred thousand, a lender often write down $15,000 with debt facing your. If your LVR is less than 80% Me may be able to offer a much better rate.

A couple of Australia’s very recognisable banking companies brought up repaired financial rates to the Saturday, followi.

.. Your credit score is an essential section of your house mortgage application. The free tool will give a quotation away from how big a great home loan a loan provider is generally willing to render for your requirements considering your income and you will costs.

An excellent PriorityBuyer page is actually subject to change otherwise cancellation in the event the a good expected loan no longer matches applicable regulating standards. When making an application for a home loan having somebody, lenders usually typically think both your earnings. In case your previous points is a sign of your capability in order to help save, up coming credit history is an indication of your capability and make quick mortgage payments. Credit fitness can be obtained free of charge away from on the internet credit rating characteristics. Furthermore, the size of your deposit doesn’t only apply at your borrowing from the bank capability, but could in addition to stop you from paying loan providers mortgage insurance coverage (LMI).

Downpayment to your property: Simply how much Do you really need?

Should your lender doesn’t monitor overdraft restrictions on the internet or even in statements, give them a visit and ask. Just how that it metric is actually computed and translated may vary somewhat anywhere between lenders. Such, for individuals who provide the exact same economic information to help you a few additional loan providers, they could report your credit electricity really differently.

- Their borrowing capability may vary when you done the full research otherwise application for the loan because there are most other adding points that simply cannot become shown thanks to a great calculator.

- Certain lower-put (large LVR) exemptions are allowed, offered you really can afford the newest money.

- However, before applying to have a mortgage, it want to take out a car loan to restore Alex’s dated one.

- Subtract their expenses out of your income to determine that which you you may repay.

- People advice otherwise details about the site does not get to the account your own expectations, finances or requires and you will imagine whether it is appropriate for your.

Constantly, in initial deposit over 20% makes it possible to bypass LMI, potentially helping you save thousands to the extra can cost you. It’s important to remember that that it formula isn’t a deal away from borrowing from the bank, nor can it serve as a pre-degree for financial recognition. Your own borrowing from the bank capacity may vary after you complete a full evaluation otherwise application for the loan because there are other contributing things that cannot getting mirrored thanks to a great calculator. Consider our listing below in order to demonstrably understand the correct will cost you doing work in to purchase a home to help you set a total budget that includes the fees. Starting a property get with a comprehensive comprehension of the new upfront will cost you may help avoid surprises.

Get into your earnings and expenses to ascertain how much you you are going to obtain to own a home loan. The complete field was not thought in selecting the aforementioned issues. As experienced, the product and you may rates have to be certainly published to your unit provider’s website. YourMortgage.com.bien au, InfoChoice.com.bien au, Discounts.com.au and you will YourInvestmentPropertyMag.com.au are included in the newest InfoChoice Class.

Estimate exactly how much the prospective borrowing strength for your home financing might possibly be

Borrowing from the bank strength, yet not, investigates extent you could use, and the property beliefs you can manage based on how much you can subscribe to mortgage repayments. Speaking of taken into account when a lender ratings your own borrowing from the bank energy and they are a generally missing responsibility. Although not, by March 2025, should your HECS-Let loan can be paid ‘regarding the close name’ a lender can pick to ignore you to definitely personal debt when figuring the borrowing strength. You happen to be in the end happy to buy your very first household, but rescuing in initial deposit is just one action. Of a lot earliest-date buyers believe that after they reach the discounts mission, securing home financing is easy. Although not, lenders assess more than just offers—they consider money, expenditures, and you may financial history.