Although this added bonus demands a longer union than just some others, they promotes a great protecting designs and you can has a leading focus rates. The possible lack of month-to-month charge and you will minimal 1st put helps it be open to really savers. Alliant Borrowing Union, together with personal fund expert Suze Orman, also offers another offers extra you to definitely prompts consistent protecting models. Another is a $fifty put suits to have beginning an intelligent Managed Collection. You can discover more on the Stash promo webpage, which explains for each and every added bonus and its own standards.

The lending company also offers improved chosen buy-to-help repaired prices at the 60% and you can 75% loan to help you value. However, however some loan providers try moving up repaired cost, most other lenders are bringing the opportunity to reduce rates and capture greater business. MPowered Mortgage loans have reduce the price of their a few and you will three-12 months domestic home loan rates because of the as much as 0.twenty eight percentage issues. Virgin Currency has increased the expense of a selection of its residential buy product sales, readily available thanks to brokers, from the as much as 0.dos fee points, productive of 15 November. Among the speed rises its a couple of- and you may five-year purchase selling from the 85% LTV have increased in cost, that have four-12 months rates carrying out in the 4.59% having a good £999 fee.

But at the same time the lending company has increased the cost of picked sales across highest mortgage to help you well worth ratios. Such as, its two-seasons fixed rates to possess household purchase from the 90% LTV could have been forced right up from 5.23% in order to 5.35%. The bank’s four-seasons commission-totally free repaired rates for remortgage, and from the 90% LTV, is now priced at 5.23%, upwards of 5.18%. Halifax for Intermediaries also has smaller the expense of selected residential remortgage sale.

A closer look ahead family savings/money field account bonuses

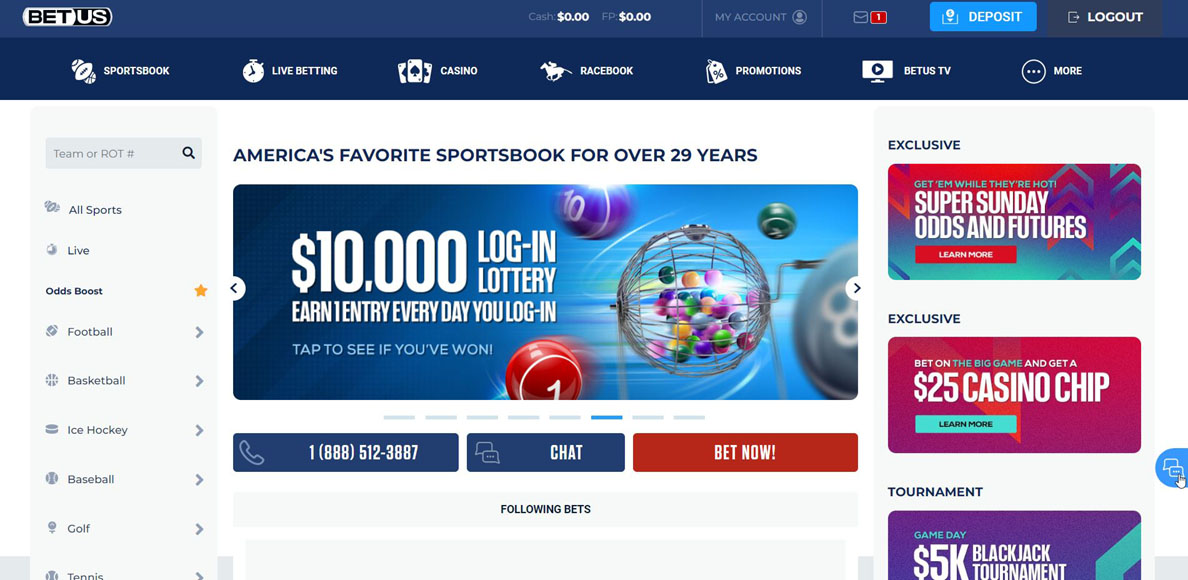

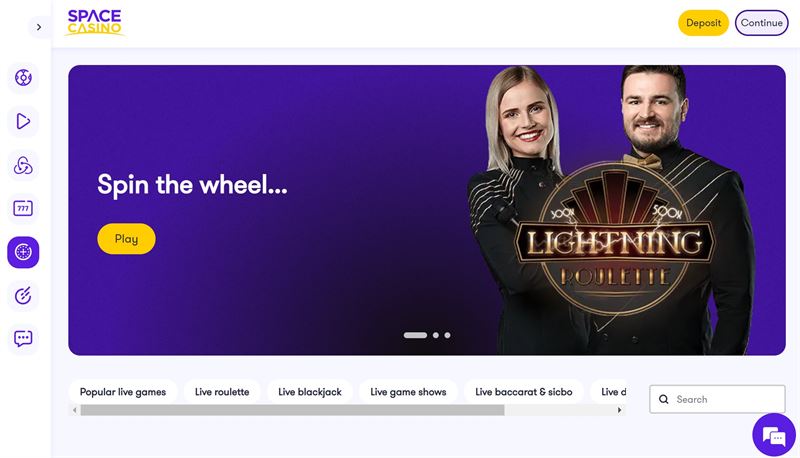

All subscribed and you may managed internet casino doing work in the united states needs the very least put before you start out with genuine-money playing. The minimum expected number are different and change in accordance with the seller you decide on. This article will reveal the web Gambling establishment and you may Sweepstakes Internet sites that offer a minimal places, in addition to $1 minimal put casinos Usa, letting you play on a funds.

PREDICTORS To have READMISSION Within the Freshly Recognized PEDIATRIC INFLAMMATORY Colon Condition

Chase is one of the prominent banking institutions in the You.S. and something of the greatest federal banks. Pursue checking account provide good use of economic features in people an internet-based, and lots of accounts give a sign-right up extra. Certain banking companies and you can borrowing unions give cash signal-up bonuses to have starting an alternative account. You will find the best potential offered by the viewing the list of an informed financial incentives and you may offers, upgraded monthly. However, financial institutions create make proposes to their very best customers, have a tendency to for enhanced membership that provide services including free inspections otherwise waived Atm costs. Those accounts get enhanced criteria to possess places and/or balances, so it is vital that you see the conditions and terms for your penalties for low-compliance.

Only use Trustworthy $100 No-deposit Incentive Rules

The brand new national average prices to have Cds are step 1.68% for just one-12 months Dvds, step 1.33% for three-12 months Dvds and 1.34% for 5-seasons Cds. The brand new numbers tend to be costs to possess display certificates, that is just what these types of deposits have been called when provided by borrowing from the bank unions. The fresh FDIC reveals costs to possess eight Computer game words anywhere between one to few days so you can five years, even if not all the banking institutions and you may borrowing unions offer for each name. The new national average rates for checking profile in the united states are 0.07%, with respect to the FDIC. Certain finest desire examining membership earn much higher prices compared to federal average.

Brango Casino $125 100 percent free Processor chip No-deposit Incentive: Greatest Offer to possess Small Cashouts

Lookin much more closely in the CRE profiles, the new upward trend inside past due and you may nonaccrual non-owner-occupied assets finance continued in the 1st one https://free-daily-spins.com/slots/family-guy -fourth. The industry’s volume of overdue and nonaccrual (PDNA) non-proprietor occupied CRE finance enhanced by $step one.8 billion, otherwise 9.0 %, one-fourth more one-fourth. As the observed in which chart, devastation is targeted from the premier financial institutions, which claimed a great PDNA speed of 4.48 %, better more than their pre-pandemic mediocre rates out of 0.59 per cent.

New customers is also claim up to $1,100 inside gambling establishment loans and 350 spins on the a designated position for the DraftKings Gambling enterprise promo password render. You can generate as much as $step 1,100000 back to bonuses for web loss in your earliest 24 occasions following choose-in the. However, there aren’t any deposit gambling establishment bonuses which come as opposed to so it restrict. Develop the brand new ‘Wagering requirements’ box close to one totally free incentive listed above to learn about their restricted game and you may wagering share.

It is very growing particular pick-to-help fixed cost, by to 0.dos payment items, while you are selected unit transfer sale for existing individuals tend to increase because of the up to 0.twenty five percentage items. Gen H have slash fixed costs across the range by up to 0.14 commission points for new consumers or over so you can 0.3 commission issues to own existing consumers trying to find an item import package. Customers are expected to utilize Gen H’s legal advice so you can qualify for the offer. All over the country has reduce prices for new and you may existing customers across the their first-time consumer and you may homemover diversity by to 0.twenty-five commission issues. The lending company has to offer two-and you will five-year repaired price sale both coming in at 3.89% having a £step 1,499 percentage and you can 40% deposit. Skipton building people has increased repaired prices round the a range of the domestic get and remortgage selling, in addition to the a hundred% LTV four-season fixed-rates financial offer (History) to have first-time buyers).

All that is always to state, today stays an enjoyable experience when planning on taking advantageous asset of highest production to your discounts. And it also’s not difficult to get a top-yielding checking account, especially from the an online-only financial. Such banks along with generally don’t require a set minimum harmony otherwise costs month-to-month services fees. The new Loss Conserve account is a leading-yield family savings that provides an aggressive interest rate.

Researching Cds to many other Financial products

Rather than opening an excellent Cd account with a financial, you should buy a great Video game thanks to an agent for example Leading edge. We love that account now offers a yield out of — APY and will become exposed that have a low lowest deposit specifications out of $250. Solution Credit Relationship Display Certification’s half dozen-few days Video game made our very own listing of better Cd rates, providing an impressive step three.25% APY and just demanding at least put away from $five-hundred. All of the industrial banks mutual forgotten from the $1 trillion inside dumps between the 1st price walk inside March 2022 because of Get 2023, just before the history rate walk. This sort of diving inside the dumps, inside buck words as well as in payment terms, had no time before took place the information going back to 1975.

Foundation Mortgage brokers made significant incisions around the its repaired rates buy-to-assist mortgage set of as much as 0.55 fee items. One of many financial’s BTL selling, readily available because of agents, it has a couple- and you may five-season repaired costs which range from cuatro.09% that have a good 4% fee (65% LTV). NatWest features nudged down the prices for the selected selling, offered because of brokers, along with a couple of and four-seasons remortgage costs. It’s providing a two-seasons repaired price to own remortgage at the step 3.92% which have a good £step 1,495 payment, and you can a good five-year equivalent package during the step three.95% (one another sale want 40% collateral in the possessions, 60% LTV). Accord Mortgages, the fresh professional credit sleeve out of Yorkshire strengthening area, have cut chosen fixed price pick-to-help money by the around 0.08 payment points, effective out of 19 Summer. It has a about three-seasons treatment for BTL remortgage at the 4.32% having an excellent £995 percentage (60% LTV).

A couple of, have at the least $twenty five as a whole continual automated transmits away from an individual Pursue checking membership. About three, features an excellent Pursue College or university Examining℠ account related to that it account for overdraft protection. And, four, connect your Pursue Prominent And Checking℠, Chase Sapphire℠ Checking otherwise Chase Private Consumer Examining℠ account. Chase Lender provides clients a $two hundred extra to own opening another Pursue Discounts℠ membership.